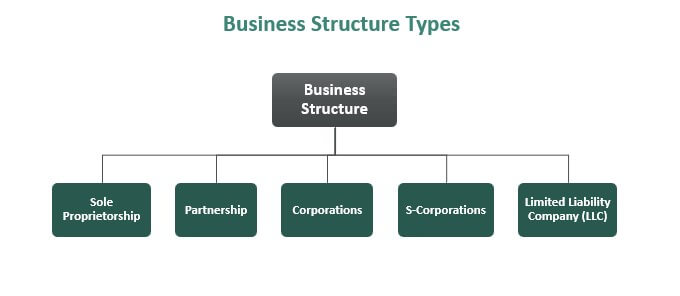

Choosing the right business structure is a crucial decision when starting a medical practice. The structure you choose affects your taxes, liability, and the overall management of your practice. This guide will help you understand the various options and make an informed decision.

1. Sole Proprietorship

Overview:

A sole proprietorship is the simplest business structure. It’s easy to set up and gives you complete control over your practice.

Advantages:

- Simple and inexpensive to establish.

- Complete control over decisions.

- All profits go directly to you.

Disadvantages:

- Unlimited personal liability for business debts and legal actions.

- Harder to raise capital.

- Less credibility with potential partners or investors.

Best For: Solo practitioners or small practices just starting out.

2. Partnership

Overview:

A partnership involves two or more people who share ownership and responsibilities. It’s a common structure for medical practices with multiple doctors.

Advantages:

- Shared responsibilities and resources.

- Easier to raise capital and share costs.

- Profits and losses are shared among partners.

Disadvantages:

- Shared liability for business debts and legal actions.

- Potential for disputes between partners.

- Decisions require consensus, which can slow down the process.

Best For: Medical practices with multiple doctors or professionals.

3. Limited Liability Company (LLC)

-

Overview:

An LLC combines the flexibility of a partnership with the liability protection of a corporation. It’s a popular choice for many medical practices.

Advantages:

- Limited liability for owners.

- Flexible management structure.

- Pass-through taxation, avoiding double taxation.

Disadvantages:

- More complex and costly to set up than a sole proprietorship or partnership.

- Varies by state in terms of regulation and fees.

- Can be subject to self-employment taxes.

Best For: Practices looking for liability protection with flexible management.

4. Professional Corporation (PC) or Professional Limited Liability Company (PLLC)

Overview:

PCs and PLLCs are designed specifically for licensed professionals, including doctors. They offer liability protection but come with specific regulations.

Advantages:

- Limited liability protection.

- Potential tax benefits.

- Enhanced credibility with patients and partners.

Disadvantages:

- More complex regulatory requirements.

- Restrictions on ownership and management.

- May have higher administrative costs.

Best For: Medical practices seeking strong liability protection and professional credibility.

5. S Corporation

Overview:

An S Corporation is a special type of corporation that allows profits to pass through to shareholders’ personal tax returns, avoiding double taxation.

Advantages:

- Limited liability protection.

- Pass-through taxation.

- Potential for lower self-employment taxes.

Disadvantages:

- Strict requirements for maintaining S status.

- More administrative work and paperwork.

- Limited to 100 shareholders, all of whom must be U.S. citizens or residents.

Best For: Practices that anticipate growth and seek tax benefits with liability protection.

Conclusion

Selecting the right business structure for your medical practice is a vital decision that affects your practice’s operations, taxes, and liability. Each structure has its benefits and drawbacks, so it’s essential to consider your practice’s specific needs and long-term goals. Consulting with a legal or financial advisor can provide tailored advice and ensure that you make the best choice for your situation.